What Is Escrow in Buying or Selling Real Estate?

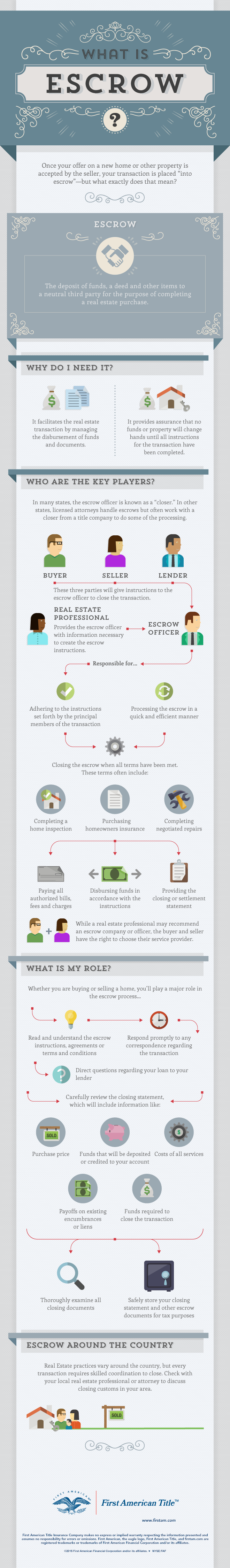

In the process of buying or selling real estate, the legal transaction is done through the escrow process.

You’ve likely heard the term, but many buyers and sellers have questions about what it really means and how it all works. To further complicate matters, your transaction also will require the services of a title insurance provider, typically referred to simply as a title company.

Both the title insurance and escrow functions are complex and governed by state and federal laws.

But what does all that really mean to you?

How Escrow Works when Buying or Selling Property

Escrow is a generic legal term that refers to a neutral, third-party repository for money and legal documents. In a more practical sense, you can think of escrow as the way we make sure everyone lives up to their contractual obligations in the real estate sales process.

In the buying and selling of real estate, the transaction concludes (“closes”) when consideration — typically cash money — is traded for the property’s deed. As the seller, you wouldn’t want to hand over the signed deed until you have the cash in hand. But from the buyer’s perspective, you wouldn’t want to hand over your money until you have the deed.

The escrow agent collects the funds and the property’s deed, and when everything is in order, distributes them to the seller and buyer, respectively.

Of course the process is never that simple, and a variety of other documents, signatures and considerations are usually involved. For example, if the seller has a home loan, the escrow officer must use the buyer’s funds to pay the loan off before the bank will release its interest in the property and allow title to transfer.

What Does the Title Company Do?

California allows a variety of duly authorized agents — including real estate brokers, attorneys and banks — to act as escrow agents in the buying or selling of real estate. However, in most transactions, the title company also will handle the escrow.

The title company’s main function is to verify the property’s ownership records to ensure that the deed can be legally transferred from seller to buyer without fear that someone else has legitimate claim to (or against) the property. A title officer will review the property’s history and identify any issues that must be resolved before title to the property can transfer.

Once those issues are taken care of, the title company will issue a title insurance policy to the buyer, ensuring against future claims on the property.

How to Choose the Best Escrow Agent & Title Company

The services all title and escrow companies provide are virtually the same, so how do you know which one to choose? Traditionally, the individual or company buying the real estate has the option to select the title company (although exceptions to this practice are common).

The California Department of Insurance licenses and regulates title insurance companies, and you can verify the license status of a title company on their site. You also can check the status of a licensed or controlled escrow company through the California Department of Business Oversight.

You can learn more about the entire title and escrow process with this comprehensive guide to understanding escrow, provided by the California Department of Real Estate.

In addition to performing your own research, however, we recommend asking your Realtor® for a recommendation for title and escrow services.

The Edie Israel Team works every day with the best title insurance and escrow agents in Southern California. We have carefully cultivated professional relationships to ensure that our clients get the best customer service available in the industry. We also are happy to explain the process to you and answer all of your questions about this complex legal process.

Contact the Edie Israel Team of professional Realtors® today, or whenever you need exceptional service and assistance with buying and selling real estate.